7 manfaat Financial Planning yang Memperkuat Kondisi Keuangan Anda

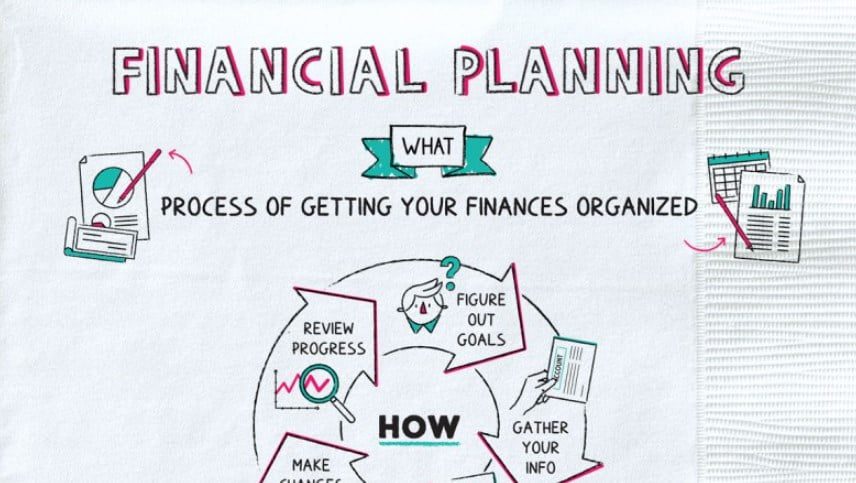

Financial Planning adalah seperangkat rencana yang digunakan untuk mengelola keuangan pribadi seseorang guna mencapai suatu tujuan keuangan. Lalu mengapa Financial Planning itu penting?

Manfaat dari Financial Planning

1. Pantau kondisi keuangan

Financial Planning membantu Anda memantau kondisi keuangan Anda. Apakah itu sehat? Atau apakah Anda juga dalam risiko finansial, seperti utang, risiko tak terduga, bahkan kebangkrutan?

Dengan melakukan Financial Planning, Anda dapat melihat kondisi keuangan Anda saat ini dan dengan mudah melacaknya. Anda dapat melihat apakah kondisi keuangan Anda sehat atau dalam kondisi buruk dengan kriteria sebagai berikut:

Simpan setidaknya 20% dari penghasilan bulanan Anda;

Hutang bulanan (baca: cicilan) tidak melebihi 30% dari penghasilan bulanan;

Memiliki dana darurat (cair) sebesar 6-12 kali pengeluaran bulanan; sebaik

Sisihkan 10% dari penghasilan Anda untuk perlindungan finansial berupa asuransi.

Tentu saja, poin ini adalah bagian kecil dari Financial Planning. Untuk informasi lebih lanjut, Anda dapat berkonsultasi dengan artikel tentang Financial Planning.

2. Membuat anggaran

Financial Planning tidak sebatas memantau jika kondisi keuangan Anda sehat, tetapi juga tentang membuat anggaran. Dengan anggaran Anda dapat:

Tahu persis di mana uang Anda “pergi”;

Batasi pengeluaran Anda;

Lebih fokus menabung untuk mencapai tujuan finansial;

Melacak keuangan untuk melacak pengeluaran dan pendapatan.

Tanpa adanya anggaran, Financial Planning juga tidak akan optimal.

3. Mencegah hutang

Dengan membuat anggaran dan memantau kondisi keuangan, risiko utang akan berkurang. Padahal, pemantauan kondisi keuangan bisa memberi tahu Anda jika kondisi utang Anda sudah melebihi batas yang sehat.

Mencatat juga dapat membantu Anda mengatasi ketidakseimbangan yang mungkin disebabkan oleh utang.

4. Membantu menentukan asuransi yang dibutuhkan

Setelah Anda memiliki fondasi keuangan yang kokoh, seperti mengetahui cara melunasi hutang dan memiliki dana darurat, langkah selanjutnya adalah memiliki asuransi. Seperti kondisi keuangan Anda seperti rumah yang baru saja Anda bangun. Jika ada tornado, maka Anda harus memulai dari awal lagi.

Demikian juga, kondisi keuangan Anda dapat hancur oleh risiko keuangan yang tidak terduga. Baik itu kematian pencari nafkah, kecelakaan, tagihan medis yang membengkak dan banyak lagi. Oleh karena itu, Anda memerlukan perlindungan finansial dari asuransi untuk membantu membangun kembali situasi keuangan Anda.

Anda biasanya membutuhkan 5-10 persen dari pengeluaran bulanan Anda untuk perlindungan asuransi. Namun, Anda juga dapat menghemat uang dengan mempertimbangkan asuransi online. Pasalnya, asuransi online jauh lebih murah. Jika melihat asuransi jiwa Super You by Sequis Online, hanya mulai dari Rp 30.000 per bulan.

5. Membuat rencana investasi

Setelah Anda memiliki dasar keuangan yang kuat dan perlindungan keuangan, Anda dapat memulai rencana investasi. Dengan cara ini, Anda mulai membangun penghasilan pasif secara bertahap.

Dengan investasi, uang yang Anda kumpulkan dapat meningkat dan juga dapat melawan inflasi. Melakukan Financial Planning membantu Anda membuat rencana investasi. Mulai dari pemilihan jenis investasi yang tepat untuk Anda, jangka waktu investasi, hingga membantu Anda memantau hasil investasi yang Anda peroleh saat ini.

6. Membangun sumber daya

Tidak hanya untuk fondasi keuangan dasar, memiliki rencana keuangan dapat membantu Anda membangun sumber daya. Baik itu aset pribadi maupun aset perusahaan, Financial Planning memegang peranan penting.

Dengan fitur-fitur seperti pelacakan keuangan, penganggaran, pencegahan hutang, asuransi, investasi, Anda dapat menggunakan Financial Planning untuk mencegah “kerugian” dan meningkatkan penghasilan Anda. Secara otomatis, ini akan memudahkan Anda untuk membangun sumber daya Anda sedikit demi sedikit.

7. Membantu mencapai tujuan keuangan Anda

Ketika Anda telah membangun sumber daya, Anda akhirnya akan dapat mewujudkan tujuan keuangan Anda. Entah itu kehidupan lama yang terkonsolidasi, bisa menyekolahkan anak, punya bisnis atau lainnya.

Yuk, Memulai Financial Planning!

Tentunya kamu bisa memulai ini dengan yang dasar dulu, seperti cara melunasi utang, membuat anggaran, dan mencarikan asuransi untuk dirimu. Kalau masalah asuransi, kamu bisa mencoba dengan Super You by Sequis Online terlebih dahulu!