Connecticut Car Insurance Quotes: Understanding the Benefits

Car insurance is a necessary aspect of car ownership, providing financial protection in the event of an accident, theft, or other covered event. If you’re a resident of Connecticut Car Insurance Quotes, or just driving through, it’s important to understand the benefits of car insurance and how to find the right policy for your needs.

Connecticut Car Insurance Quotes

Car insurance can help cover the cost of repairing or replacing your car, as well as medical expenses for you and other passengers. Some policies even offer additional coverage for expenses such as rental cars and roadside assistance. With car insurance, you can have peace of mind knowing that you’re protected in the event of an unexpected incident on the road.

Different Types of Car Insurance Coverage

There are several types of car insurance coverage available, including:

- Liability Coverage: Liability coverage helps to pay for damages or injuries that you may cause to another driver or their property in an accident. This is the most basic type of car insurance and is required by law in most states.

- Collision Coverage: Collision coverage helps to pay for repairs or replacement of your car if you’re in an accident. This type of coverage is optional.

- Comprehensive Coverage: Comprehensive coverage helps to pay for damage to your car from events other than a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage helps to pay for damages.

Factors That Affect Your Car Insurance Premiums

Your car insurance premiums are determined by several factors, including:

- Driving Record: Your driving record, including any accidents or traffic violations, can impact your insurance premiums. A clean driving record can result in lower premiums, while a history of accidents or violations can result in higher premiums.

- Age and Gender: Age and gender can also play a role in determining your insurance premiums. Young drivers and males are typically considered higher risk and may pay higher premiums as a result.

- Vehicle Type: The type of vehicle you drive can also impact your insurance premiums. Sports cars, luxury vehicles, and other high-performance cars may be more expensive to insure due to their higher risk of accidents and theft.

- Location: Where you live and park your car can also affect your insurance premiums. If you live in a high-crime area or an area prone to natural disasters.

- Coverage Amount: The amount of coverage you choose can also impact your insurance premiums. Higher coverage amounts may result in higher premiums.

How to Get Connecticut Car Insurance Quotes

Getting Connecticut car insurance quotes is easy. Here are a few steps to help you get started:

- Gather Information: Before getting a quote, gather information about your car, driving history, and coverage needs. This will help you provide accurate information to the insurance company and get an accurate quote.

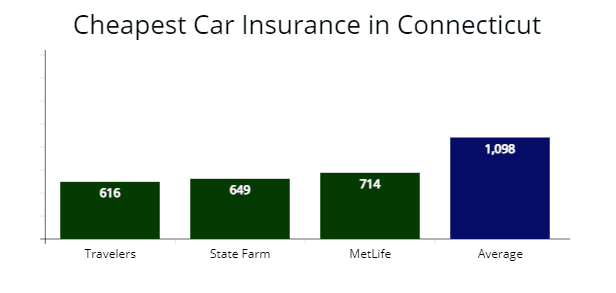

- Shop Around: Get quotes from multiple insurance companies to compare coverage options and premiums. You can get quotes online, over the phone, or through an insurance agent.

- Compare Quotes: Compare the quotes you receive to find the right policy for your needs. Don’t just focus on the price, but also consider the reputation and customer service of each company.

Conclusion

Car insurance is a necessary aspect of car ownership that can provide peace of mind and financial protection on the road. If you’re a resident of Connecticut or just driving through, it’s important to understand the different types of car insurance coverage.

Suggestions

If you’re looking for car insurance in Connecticut, consider shopping around for quotes from multiple insurance companies. Compare coverage options and premiums to find the right policy for your needs. Don’t hesitate to ask questions and seek advice from your insurance agent to make an informed decision.